Fifty-five-year-old Launceston woman Susan* broke into tears as she realised what the removal of the current $150 subsidy of JobSeeker would mean.

Subscribe now for unlimited access.

or signup to continue reading

Since losing her job late last year, Susan has fractured her arm and now finds herself unable to work and relying on the payment.

"I won't have anything left ... it's no wonder you want to kill yourself, it's horrible," she said.

IN CASE YOU MISSED IT: Rossarden carries a reputation is had no choice in, but the headlines are far from the truth

After being employed in jobs varying from cleaning to laundry work for a number of years, finding herself needing to call upon the JobSeeker payment was a shock to her system.

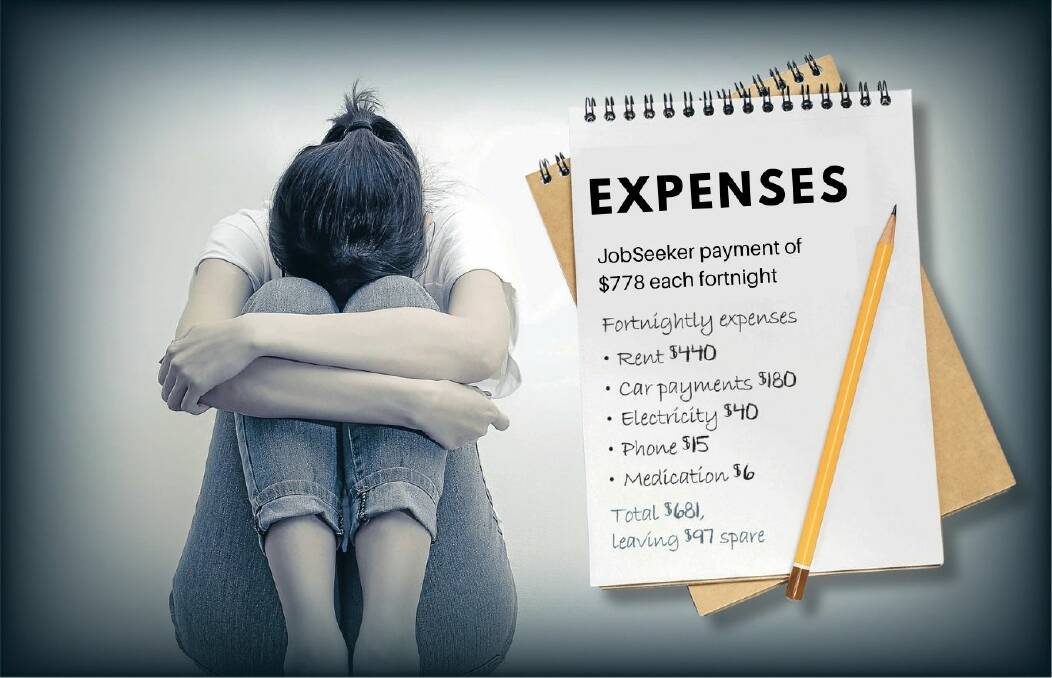

Tied into a rental agreement and in the process of paying off a car loan, having to receive the government payment meant she would be left with less than $100 each fortnight to spend on food and other necessities.

"I go without food just to pay my rent, my car payment and my electricity," Susan said.

I just go without things. I try and just live on cheap food like sausages. I ate them for four days straight.

- Susan

"I have breakfast cereal and sometimes I just have noodles for lunch because it's cheap."

Each fortnight, when Susan receives her JobSeeker payment, she sets out how she will go about paying her bills.

There is a payment of $440 for rent, which she prioritises, following with $180 for her car, $40 for electricity, $15 for her phone and about $6 for her medication for depression, although sometimes she goes without because she cannot afford it. She also has had to make the choice not to insure her car because she cannot afford the payments.

Susan currently receives $778 each fortnight from JobSeeker which includes rental assistance. After she takes out her $681 of bills, that leaves her with $97.

When the JobSeeker supplement is cut at the end of March, and despite the much publicised $50 increase amounting to $3.57 a day, Susan will need to find $47 somewhere to be able to pay all of her bills.

The thought of losing the subsidy has clearly been something Susan has pushed to the back of her mind, but the reality of it staring her in the face was overwhelming.

"I'm not going to be able to [afford my medication]. Once JobSeeker reduces I'll only be able to pay my car and rent and that's it," she said, fighting through tears.

I'm not going to be able to [afford my medication]. Once the JobSeeker reduces I'll only be able to pay my car and rent and that's it.

- Susan

"[When I'm off my medication] I get really sad and just sit there and cry and I don't want to be here. When I'm on the tablet it makes me stronger."

The prospect of not being able to access medication for her depression threatens to have a compounding impact as she tries to get back into the workforce.

Without being able to work she has found her depression has become more difficult to battle because she is unable to drive or undertake typical day-to-day tasks like hanging out the washing.

"I get depressed because I'm stuck at home all the time because I have no money to go anywhere," she said.

Being at home exacerbates Susan's depression and she finds herself sleeping for much of the day.

RELATED: IN CASE YOU MISSED IT: 'It doesn't last': the tight squeeze on JobSeeker and the pension

"Usually I get up and a couple hours after I get up, because I've got nothing to do, I get depressed and I just fall back asleep."

Since fracturing her arm, the necessity of work for her has been reinforced. Ideally for Susan, receiving the JobSeeker payment is just a temporary gap until she can work again.

The process has been dragged out by the fact she is still nursing the fractured arm, even still, getting back into the workforce is her priority.

As a result, Susan thinks, at this stage, the mutual obligations that will be reintroduced and adjusted as part of the reshaping of the JobSeeker payment should not have a significant impact - because of her want to be working.

Those mutual obligations mean, while a person receives JobSeeker, they will need to apply for 15 jobs each month from April, before it rises to 20 per month from July 1.

Other changes mean recipients will need to undertake a short course or work experience after six months, and there will be an "employer reporting line" set up to report to the government when a "qualified" person is offered a suitable role but then decline that job.

When Susan first came onto the JobSeeker payment there were no application obligations but she still dropped in resumes before finding casual employment.

Susan said working was enjoyable for her, and the ability to work a solid eight hour shift actually helped with her depression.

"I can't survive just on unemployment, I want to work," she said.

"When I was working I was never happier because I was doing eight hour shifts ... I thought it was amazing."

St. Vincent De Paul Society Tasmania chief executive Lara Alexander said the changes threatened to throw the thousands of Tasmanians still relying on the payments into poverty as they continue to feel the effects of the COVID-19 pandemic.

RELATED: IN CASE YOU MISSED IT: 'You could eat fresh food': JobSeeker recipient and charity fear the end of COVID subsidy

"The view of the St. Vincent de Paul Society, along with many politicians, business leaders and other advocates is that the JobSeeker payments will deliver better outcomes if it is aligned with pensions which, for a single person, is around $920 per fortnight.

"This should be complemented by an overall review of social benefits to reflect contemporary needs in the Australia today."

Prime Minister Scott Morrison said the payment is designed as a "safety net, not a wage supplement".

"[The increase] puts the JobSeeker payment at 41.2 percent of the national minimum wage ... it is the single largest increase in the JobSeeker payment since the mid-'80s," he said.

*Name changed for privacy reasons.

Need help?

- Lifeline 13 11 14

- Suicide Call Back Service 1300 659 467

Our journalists work hard to provide local, up-to-date news to the community. This is how you can continue to access our trusted content:

- Bookmark www.examiner.com.au

- Make sure you are signed up for our breaking and regular headlines newsletters

- Follow us on Twitter: @examineronline

- Follow us on Instagram: @examineronline

- Follow us on Google News: The Examiner

What do you think? Send us a letter to the editor: